Commercial Bridging Loans

Bridging loans are a short-term funding product and secured against property. Bridging loans, also known as bridging finance, can be used to fund almost any property transaction and are often utilised to fund otherwise unmortgageable property.

Historically, bridging loans have been expensive, and this has caused people to shy away from them, but that's all changing. Rates are dropping while competition between lenders is increasing. For that reason, the principal beneficiary is the borrower.

In this guide, we'll cover the fundamental points of bridging loans. You'll see how the application process works, how to get the best deal and even how much you'll pay in rates and charges. You'll see other lenders, rather than asking for bank finance, that includes brokers and peer-to-peer lending.

Table of Contents

- How Do Bridging Loans Work?

- Why Use Bridging Finance?

- Bridging Loan Lending Rates & Terms

- Key Points To Consider When Taking Out A Bridging Loan

- Choosing The Best Product

How Does Bridging Finance Work?

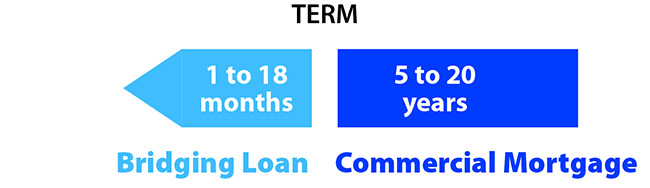

Bridging loans are usually arranged very quickly and are designed to cover a short period of time, from one to 18 months. Because these work differently from traditional secured business loans, there's an element of flexibility offered.

At the end of the term, the loan is usually repaid by refinancing to longer-term debt, usually a commercial mortgage, or through the sale of the property.

Interest-Only Short-Term Borrowing Options

All bridging loans get arranged on an interest-only basis. That means there is no requirement to repay any of the capital borrowed during the term of the agreement.

1: Monthly Interest Payments

There are two options for paying the interest on a bridging loan; the first is to make the monthly payment, as you would on a mortgage.

2: Pay Interest at The End of the Loan

If you do not want to, or would find it difficult to make the monthly repayments, the interest can be rolled up into the loan. This method means there are no payments to make during the term of the loan. Instead, the amount required to redeem the loan increases each month and the total gets repaid at the end of the agreement.

This second arrangement can be a lot easier to manage for the borrower because the interest incurred is paid out of either the sale proceeds or the funds raised through refinancing.

Why Use Bridging Finance?

There are all manner of reasons to consider when using bridging finance and many types of bridging loans you can choose from for your business. In essence, this type of loan gets used by business owners for three main reasons.

1: Property Purchases

Firstly, the commercial property market is less liquid than buying property in the residential market. As a result, it's far more common to pick up a property bargain undervalue, especially if you're able to complete quickly.

Commercial mortgages can take months to complete, which prevents you from committing to a fast completion, meaning your only options are a cash purchase or a bridging loan.

Auctions purchases are a perfect example. When you grab a bargain at auction, you must pay a non-refundable 10% deposit immediately. You are then expected to complete that purchase within 28 days. Failure to do so would result in complete loss of your deposit.

Bridging loans can usually be completed in 1-2 weeks, meaning a 28-day turnaround is comfortable, but by attempting to complete using a commercial mortgage, you're putting your deposit at real risk.

2: Property Refurbishments

Secondly, when undertaking the refurbishment or conversion of a building, a traditional commercial mortgage lender would be uncomfortable in making the loan. Mortgage contracts rely heavily on the security value, and if the refurbishment was to fail, this could cause them a problem. As a result, commercial mortgage lenders will usually shy away from this type of lending.

Bridging finance lenders would be comfortable in this situation and may even lend you the money needed to complete the works.

3: Working Capital

Thirdly, most businesses will suffer cash flow problems at some time or another, whether it's a quiet trading period, or you're struggling to fund growth. If you're struggling to secure finance from unsecured business loans when you need it, then a bridging loan can be a great solution.

Even if you already have a commercial mortgage on your building, you could look at a second charge bridging loan. Bridging lenders are far more concerned about the property and exit route than anything else and will often lend where traditional lenders wouldn't, as long as there is sufficient equity.

Bridging Loan Lending Rates & Terms

Although every lender is different and will offer different terms, there are some basic parameters on what to expect when taking out a commercial bridging loan.

Bridging loan lenders will usually charge more for lending against commercial property and will offer a slightly lower loan to value.

Loan to Value Rates

When borrowing against commercial property, the maximum you can usually expect to obtain is 70% of the property value. The higher the loan to value, the more the interest rate will usually be. When borrowing 70% of the property, a realistic interest rate is 0.83% per month or 9.96% per annum.

Lower loan to value applications will usually see their rates reduce, with rates of 0.65% per month realistic up to around 50-55% of the property value.

Additional Charges to Expect

In addition to the interest charged, most lenders will usually charge an arrangement fee of 2% of the loan. In some circumstances, the charge could reduce especially for loans over £1,000,000.

Commercial Brokers

Most brokers also charge an arrangement fee of 1% or more for arranging the loan. However, some will forego this fee altogether.

As mentioned earlier, the number of lenders in the market is growing, which is excellent news for borrowers as it increases competition. The downside to this is that it can make it far more difficult when trying to find the best deal quickly, so it's worth locating a suitable bridging loan broker that won't charge you a fee.

Bridging Loan Rates Table

| Lender | Max LTV | Max Term | Amount | Interest | Fees |

|---|---|---|---|---|---|

| United Trust | 70% | 3 Years | £10m | 0.55% | 2.00% |

| Shawbrook | 75% | 2 Years | £15m | 0.55% | 1.95% |

| Lendinvest | 75% | 3 Years | £7.5m | 0.59% | 2.00% |

| Greenfield | 70% | 1 Year | £5m | 0.65% | 2.00% |

| Fortwell | 80% | 1.5 years | £5m | 0.65% | 2.00% |

| Oblix | 75% | 1 year | £5m | 0.65% | 2.00% |

| Masthaven | 70% | 1 year | £5m | 0.68% | 2.00% |

Key Points To Consider When Taking Out A Bridging Loan

If you're looking to take out a bridging loan, there are a few key points to consider:

- Will The Benefit Outweigh The Costs? When looking to make any purchase, the first question must be the value of the product. If a bridging loan allows you to take your business to the next level or grab a bargain property, then it will clearly be worth it.

- How will You Repay the Loan? Taking out bridging finance is only half the battle, ensuring the loan can be repaid is just as important. If you have no way of repaying the loan at the end of the term, you will be in default. As with defaulting on any borrowing, this will have serious repercussions.

- Choose the Right Solicitor Bridging finance is a specialist market and to use it successfully, you need the right professionals around you. If your solicitor is unfamiliar with the processes of bridging lenders then the process will not run smoothly, so make sure you get yourself a solicitor with the relevant experience.

- How Quickly Do You Need The Money? By being clear on how quickly you need the money, you can make clear decisions on whether your aim is realistic. The speed of completion is a major differentiating factor between lenders, surveyors and solicitors. Finding the right team is simple enough, but only if it's clear what target they're all working toward will help you understand if they're right for you.

- What is More Important - Cost or Speed? If the deadline is extremely tight, you may find yourself having to make a tough decision between hitting the deadline or choosing the cheapest lender. It's an important consideration and one that we always advise you avoid by applying for your bridging loan as early as possible.

Choosing The Best Product

It's not all about choosing the lowest rate. Lenders will have a number of different fees, charges and may even charge exit fees. It's important that you consider the total cost of the loan, not just the headline figures.

The bridging loan market can be complex and needs special care. Always consider every element of the loan in detail before proceeding. If you tread carefully, bridging loans can be an excellent tool for your business, but when misused, problems can arise.

Always talk through your requirements with an independent expert to ensure you get the best deal.